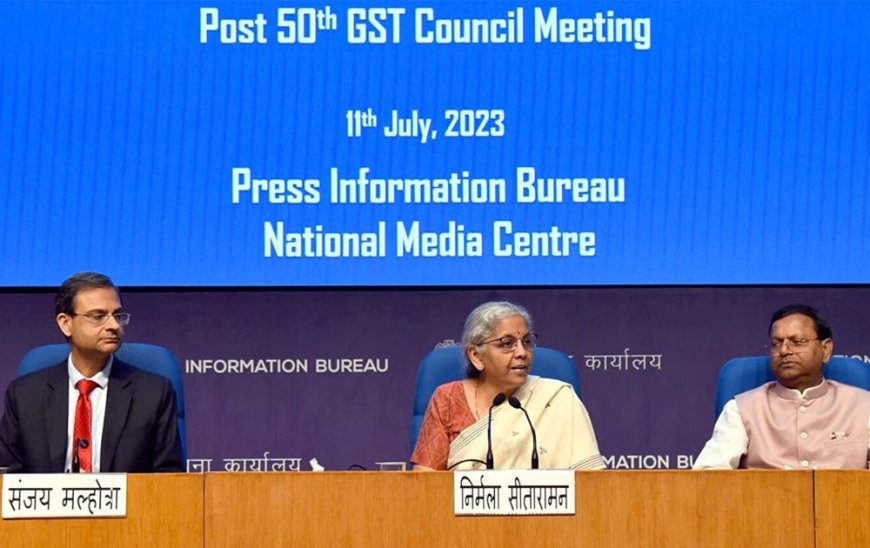

Here Is A List Of Items Whose Prices May Fluctuate As Announced During The 50th Gst Meeting.

Recently, the Union Finance Minister Nirmala Sitharaman led Goods and Service Tax Council (GST) met for the 50th time, and during this meeting, the GST announced a number of adjustments. The council made adjustments and issued amendments that increased the price of some items while lowering the cost of others.

Here is a list of items that have dropped in price and those that have increased in price and are now expensive. Let's look at it.

Things that have decreased in price:

1. Instead of the current 18% GST rate, popcorn and other food and drinks consumed in multiplexes will now be subject to a GST of 5%.

2. The GST on snack pellets, a semi-finished component used in the production of snacks, has been reduced from 18 to 5 percent. Snack palettes that are raw, unfried, or extruded fall under this category.

3. The amount of fish-soluble paste has decreased from 18 to 5 percent.

4. The GST Council stated that the LD slag (steel slag) standard must be equal to that of blast furnace slag and that the GST rate has been reduced from 18% to 5%.

5. The rate of imitation zari thread has decreased from 12% to 5%.

Things that will drain your bank account:

1. The whole value of wagers made on skill-based games will be subject to a 28% tax.

2. There will be a 28% tax on the whole face value of the money in online gambling, horse racing, and casinos.

The following items are exempt from GST tax:

1. Food items used for certain medical reasons and medications for rare illnesses and cancer are excluded from the GST tax.

2. Services for launching satellites are no longer subject to GST. The goal of this action is to entice private participants into this industry as well.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0