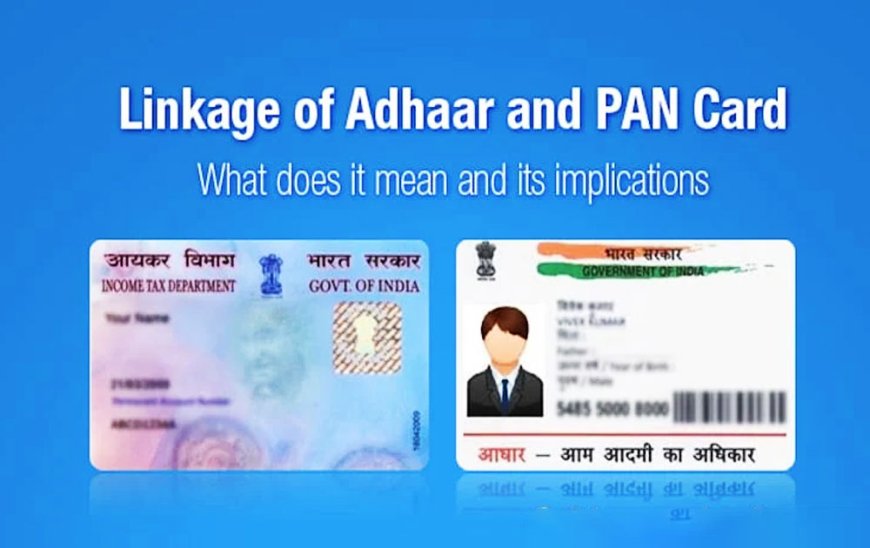

All you need to know about Aadhaar Card-Pan Card Linking last date, process, and how to check or fee if an

Over 51 lakh PANs have reportedly already been linked to Aadhaar as of this writing. You can link your PAN-Aadhaar online from the comfort of your house with simple steps owing to the simple process. However, if you have already completed the procedure or are unsure whether you have successfully linked your PAN with your Aadhaar card and want to verify if it is linked or not, don't fear. In this piece, we'll walk you through the simple steps for checking the current status of the Aadhaar card to PAN card linking online.

Every Indian citizen is required to link their PAN card to their Aadhaar card, and the limit for doing so has been prolonged from the previous date of March 31, 2023, to now on June 30, 2023. The Central Board of Direct Taxes has previously delayed the deadline for linking PAN with Aadhaar several times. (CBDT).

A recent Tweet from the Income Tax Department stated, "In order to provide some more time to the taxpayers, the date for linking PAN & Aadhaar has been extended to 30th June 2023, whereby persons can intimate their Aadhaar to the prescribed authority for PAN-Aadhaar linking without facing repercussions. From 1st July 2023, the unlinked PAN shall become inoperative with consequences. The PAN can be made operative again in 30 days, upon intimation of Aadhaar to the prescribed authority after payment of a fee of Rs. 1,000."

Linking a PAN to an Aadhaar had zero cost up until 31 March 2022; from 1 April 2022 to 30 June 2022, it had minimal fees of Rs 500. If you connect your PAN with your Aadhaar by June 30, 2023, you will now need to pay double the initial payment which makes it a total of Rs. 1000. If you don't adhere to the instructions, your PAN will stop working as of July 1, 2023.

As per the provisions of the Income-tax Act,1961 (the "Act"), every individual who had been assigned a PAN as of July 1, 2017, and was qualified to receive an Aadhaar number was required to inform the prescribed authority of his Aadhaar on or before March 31, 2023, in exchange for payment of the prescribed charge. As of April 1, 2023, doing so will result in certain consequences under the Act. The deadline to notify Aadhaar to the required body to connect Aadhaar and PAN has been extended to June 30, 2023.

How to check the current status of your PAN card and Aadhaar card linking online:

Step 1: Visit the official Income Tax e-filing portal

The following link will lead you to the same: https://www.incometax.gov.in/iec/foportal/

You would be able to see a screen as attached in the above picture.

Step 2: Go to the left side of the page, there you will see a Quick Link, under Quick Pannel, You will see ‘Link Aadhaar Status’, Click on that.

Step 3: You will be taken to the following screen(refer to the image below) after selecting the Link Aadhaar Status, where you must enter your 12-digit Aadhaar card number and 10-digit PAN card number.

Step 4:Now click on ‘View Link Aadhaar Status as shown in the following attached image.

If your PAN card and Aadhaar card are already linked you will see a pop-up on your screen that says "Your PAN AZXXXXXX7L is already linked to given Aadhaar 44XXXXXXXX41". Your screen shall look like the image attached below:

If your PAN card and Adhaar are not linked yet, you will receive a pop-up saying, "PAN not linked with Aadhaar." To link your Aadhaar with your PAN, please select the link entitled "Link Aadhaar," as shown in the image below. Please take the necessary steps to link your PAN with your Aadhaar before the deadline expires. (31 March 2023).

If you have already asked UIDAI to validate your request to link your PAN and Aadhaar, please confirm the status again afterward.

If your Aadhaar card is linked with another PAN or your PAN is linked to another Aadhaar card, kindly notify the jurisdictional AO promptly to delink both.

How can one link their Aadhaar Card with PAN Card Via SMS?

-

Type “UIDPAN < 12 digit Aadhaar number > < 10 digit PAN Number > "

-

Send this SMS to 56161 or 567678.

What's Your Reaction?

Like

1

Like

1

Dislike

0

Dislike

0

Love

1

Love

1

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

2

Wow

2